Climate change can have adverse impacts on climate insurance affordability and availability, potentially slowing the growth of the industry and shifting more of the burden to governments and individuals. Most forms of insurance are vulnerable, including property, liability, health, and life. Often small scale, gradual, diffuse, and indirect events are often overlooked like the following list:

Blackouts; Crop damages; Drought; Equipment breakdown; Eroded air quality; Eroded water quality; Hail; Ice Storms; Infectious diseases; Lightning; Mudslides; Sea-level rise/Coastal; Sinkholes; Subsidence; Thunderstorms; Tornados; Vehicle damages; Wildfire; and Winterstorms.

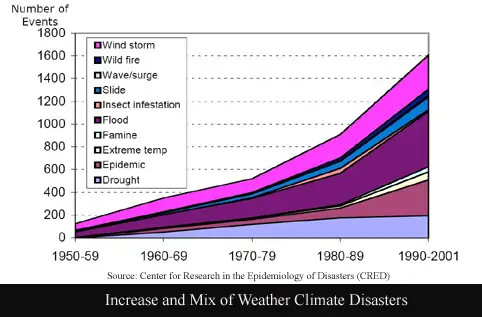

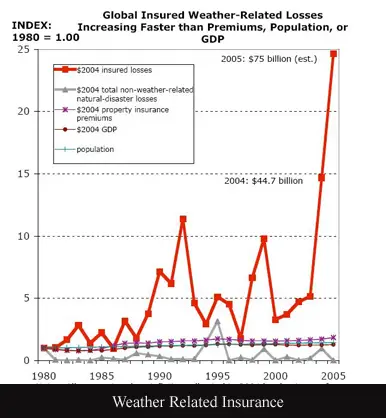

Between the 1960s and 1990s the number of natural catastrophes doubled and insured losses increased nearly seven-fold…

“As climate change spreads it generates costs in a number of ways. Changing weather patterns and rising sealevel increase the operating costs of consumers and businesses. As of 2005, considerable damage is also occurring to public and private infrastructure. This affects insurers via claims, and also banks indirectly via changes in client behaviour. In future, damage and operating costs will rise faster, to the extent that a third burden, “opportunity cost”, will emerge, the deferment of decisions due to uncertainty – as the realisation grows that climate change is a key decision factor.” (from United Nations Environment Programme, the United Nations Environment Programme Finance Initiative).

Bill McGuire, Professor of Geophysical Hazards at University College London and Director of the University’s Benfield UCL Hazard Research Centre, said “In the decades ahead, climate change will come to dominate everything in our lives; everything we do… Even if we act now to drastically curb emissions, things are going to be bad. If we do nothing, they will be far, far worse.”

The IPCC also confirms that “the combined effect of increasingly severe climatic events and underlying socio-economic trends (such as population growth and unplanned urbanisation) have the potential to undermine the value of business assets, diminish investment viability and stress insurers, re-insurers, and banks to the point of impaired profitability and even insolvency.” Climate insurance will go through the roof!

Climate Insurance in the Caribbean

The Caribbean region suffered considerable damage from severe hurricanes (e.g., David, Hugo, Gilbert, Gabrielle, Luis, Marilyn) in the 1980s and 1990s. As a direct result, many insurance and reinsurance companies withdrew from the market. Those that remained imposed onerous conditions for coverage-including very high deductibles; separate, increased rates for windstorms; and insertion of an “average” clause to eliminate the possibility of under insurance .

Recent Developments

The report, “From Risk to Opportunity 2007: Insurer Responses to Climate Change,” commissioned by the nonprofit group Ceres, outlines more than 400 climate-related activities in the US and abroad – double the number of products and services identified in a similar report done just 14 months ago. For instance, Pay-as-you-drive (PAYD) insurance products are now being offered by 19 insurers worldwide, who recognize that reduced driving means reduced accident risk, as well as reduced energy use. Tests have shown that PAYD products can reduce overall miles driven by 10-15 percent or more. About 20 percent of new customers of the French insurer AGF have elected the PAYD option, with 250,000 such policies in force. Progressive and GMAC offer PAYD policies in parts of the U.S.

Mindy Lubber, is president of Ceres, which is a leading U.S. coalition of investors and environmental groups, and believes that, “insurers are beginning to respond to global warming – and not just by withdrawing from coastal markets with high financial exposure. We’re seeing a rapid proliferation of products that will reduce climate-related financial losses, as well as the pollution causing global warming. Yet, insurer responses to date are not nearly sufficient given the scale of the challenge. We need more insurers, especially U.S. insurers, to step up.”

Overall, there is growing acknowledgement that the impact of climate change on future losses is likely to be profound. The chairman of Lloyd’s of London said that climate change is the number-one issue for that massive insurance group. Europe’s largest insurer, Allianz, stated that climate change stands to increase insured losses from extreme events in an average year by 37 percent within just a decade while losses in a bad year could top $400 billion.

Read the full Ceres climate insurance report (pdf file) From Risk to Opportunity 2007: Insurer Responses to Climate Change.