Pew Center on Global Climate Change

To meet its obligations to reduce greenhouse gas (GHG) concentrations under the Kyoto Protocol, the European Union (EU) established the first cap-and-trade system for carbon dioxide emissions in the world starting in 2005. Proposed in October 2001, the EU’s Emissions Trading System (EU ETS) was up and running just over three years later. The first three-year trading period (2005-2007)—a trial period before Kyoto’s obligations began—is now complete and, not surprisingly, has been heavily scrutinized. This report [full report available here] examines the development, structure, and performance of the EU-ETS to date, and provides insightful analysis regarding the controversies and lessons emerging from the initial trial phase.

Recognizing their lack of experience with cap and trade and the need to build knowledge and program architecture, EU leaders began by covering only one gas (carbon dioxide) and a limited number of sectors. Once the infrastructure was in place, other GHGs and sectors could be included in subsequent phases of the program, when more significant emissions reductions were needed. As authors Denny Ellerman and Paul Joskow describe, the system has so far worked as it was envisioned—a European-wide carbon price was established, businesses began incorporating this price into their decision-making, and the market infrastructure for a multi-national trading program is now in place. Moreover, despite the condensed time period of the trial phase, some reductions in emissions from the covered sectors were realized.

The development of the EU-ETS has not, however, proceeded without its challenges. The authors explain some of the controversies regarding the early performance of the EU-ETS and describe potential remedies planned for later compliance periods:

• Due to a lack of accurate data in advance of the program, allowances to emitters were over allocated. Now with more accurate emissions data and a centralized cap-setting and reporting process, the emissions cap should be sufficiently binding;

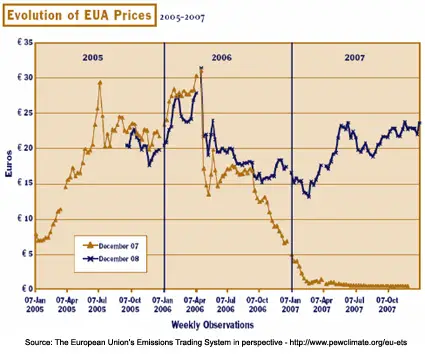

• Concerns about program volatility emerged when initially high allowances prices (driven largely by high global energy costs) dropped precipitously in April 2006 upon the release of more accurate, verified emissions data. Late in the trial phase, there was another sharp decline in allowance price because there were no provisions for banking emissions reductions for use in the second phase of the program. Improved data quality and provisions for unrestricted banking between compliance periods will help moderate price fluctuations in the future;

• Windfall profits by electric power generators that passed along costs (based on market value) of their freely issued allowances resulted in improved understanding of how member country electricity sector

regulations affect the market and calls for increased auctioning in subsequent phases of the program.

Interest in developing a national cap-and-trade program in the United States has intensified in recent years. The first comprehensive greenhouse gas reduction bill ever to be reported out of a committee emerged from the Senate Environment and Public Works Committee in December 2007. As debate continues on this landmark legislation, the House of Representatives has signaled its intention to design its own emissions trading program. This report [available here] provides an excellent resource for those developing U.S. proposals. As Europe’s experience with the EU-ETS suggests, everything does not have to be perfect at the outset of a cap-and-trade program. We do, however, need to get started and, for this, the EU-ETS has provided valuable lessons for us all.

EU Emissions Trading System – Broad Lessons Learnt

Although there have been plenty of rough edges, a transparent price on tradable CO2 emission allowances emerged as of January 1, 2005, a functioning market in allowances has developed effortlessly without any prodding by the Commission or member state governments, the trading infrastructure of markets, registries and monitoring, reporting and verification is in place, and a significant segment of European industry is incorporating the price of CO2 emissions into their daily production decisions.

The proof of the value of this experience will be seen as the second trading period progresses. So far, all indications are that the trial period accomplished its goal. The EU Emissions Trading System has evolved from being an engaging possibility in the 2000 Green Paper (EC, 2000) to being what is now regularly characterized as the flagship of the European Climate Change Program.

The trial period of the EU Emissions Trading System showed that:

•Economic impact is imperceptible

–European economy has not been “wrecked”

–No evidence of carbon leakage through trade

–Adjustments in operations and investment

–One price among many, all of which matter

•Unexpected abatement & non-directed outcomes

•Multinational systems can be constructed

–Includes 27 sovereign nations plus Norway

–EU ETS bridges wide divergence in institutional experience and per capita income

As the world moves to develop and to link GHG trading systems, challenges similar to those characterizing the EU Emissions Trading System will have to be confronted.

Source for this page:

1. The European Union’s Emissions Trading System in perspective, Prepared for the Pew Center on Global Climate Change by A. Denny Ellerman Paul L. Joskow Massachusetts Insitute of Technology, May 2008 www.pewclimate.org/eu-ets